Growth in the U.S. sex toys market reflects changing values and consumer behavior. People increasingly view pleasure products as part of a healthy, confident lifestyle. This change reflects larger cultural shifts—toward openness, tech adoption, and increasing awareness of sexual health.

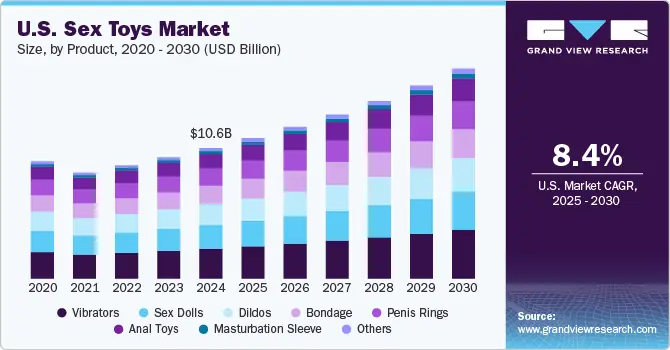

The U.S. sex toy consumer market reached over USD 10.6 billion in 2024. Analysts expect it to continue growing at a CAGR of 8.38% during the forecast period through 2030. Beyond sales, the market reflects a shift in values. Intimate products are now part of self-care and empowerment.

This report analyzes the U.S. sexual wellness market. Topics include consumer trends, technology, regional shifts, and leading brands. From Bluetooth-enabled sex toys to app-controlled couples devices, we unpack what’s driving demand—and what’s next.

Table of Content

- U.S. Sex Toys Market Overview

- Women’s Sex Toy Trends and Behavioral Shifts

- Technology and the Rise of Pleasure Tech

- Consumer Behavior and Market Segmentation

- Online Platforms and Distribution Channels

- Regional Trends in the U.S. Sex Toys Market

- Key Players in the U.S. Sex Toy Industry

- Future Outlook: Growth Forecast and Innovation

- FAQs: Insights into the U.S. Adult Product Market

1. U.S. Sex Toys Market Overview

The U.S. sex toys market has grown steadily over the past decade. Three forces drive this expansion: greater awareness, social change, and better access to technology. Pleasure products are no longer considered niche or taboo. Today, they are part of a broader conversation around personal health, empowerment, and emotional connection.

According to recent market reports, the sex toy consumer market U.S. reached over USD 10.6 billion in 2024. Analysts project the market will grow at a CAGR of 8.38% from 2025 to 2030. The rise reflects strong demand for high-quality and discreet products. Tech-enabled options support both solo and partnered intimacy.

The sexual wellness industry U.S. saw notable growth during the COVID-19 pandemic. Many consumers turned to self-care and stress relief at home. Digital habits shifted during the pandemic. This drove growth in online platforms offering discreet access to pleasure products.

As the market matures, product diversity expands. The market includes a wide range of items—from beginner-friendly bullet vibrators to advanced Bluetooth-enabled sex toys. These products serve diverse needs—preferences, relationships, and life stages. As a result, the industry is becoming more inclusive and consumer-driven.

2. Women’s Sex Toy Trends and Behavioral Shifts

In recent years, women’s sex toy trends have shifted significantly. More women in the U.S. now view pleasure products as part of self-care and emotional wellness. Greater comfort with sexuality, awareness, and dialogue is driving this change.

Younger generations, in particular, are reshaping the U.S. sex toys market. Millennials and Gen Z consumers are more likely to prioritize autonomy, consent, and sexual discovery. These users are not just seeking stimulation—they want connection, confidence, and meaningful sexual experiences.

At the same time, social media platforms have boosted demand. Influencers, sex educators, and even mainstream celebrities have normalized the use of vibrators, bullet toys, and other products. This visibility helps reduce shame and encourages more women to explore their desires.

Shoppers increasingly prefer discreet, elegant, and premium design. Women expect their toys to reflect both function and aesthetics. As a result, the market now offers curated collections, minimalist packaging, and inclusive language. These features help build trust and increase demand for sex toys among diverse users.

3. Technology and the Rise of Pleasure Tech

Experts analyzing the sex tech market report that technology is rapidly transforming the U.S. sex toy consumer landscape. Buyers now look for design, simplicity, and smart control.

Many devices are now app controlled and Bluetooth enabled, allowing partners to stay connected from anywhere. Remote control and customizable settings have become standard. These technological advancements are making intimacy more personal and interactive.

Analysts in the sex tech industry report that buyers seek more than pleasure. They seek innovative products that offer wellness features like breath tracking and pelvic floor support. As demand grows, brands are combining physical pleasure with smart design.

The U.S. sex toys market is entering a new era—one defined by connection, data, and meaningful experiences.

4. Consumer Behavior and Market Segmentation

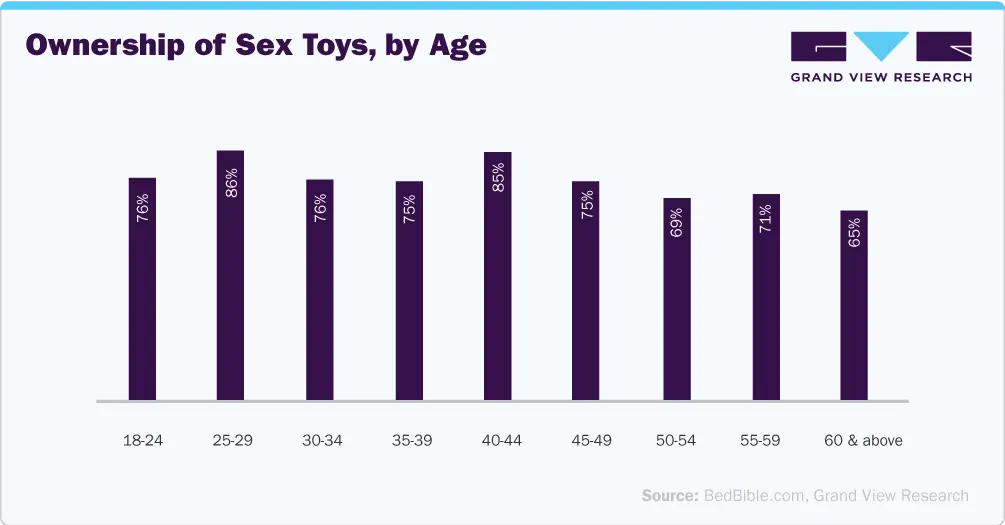

The sex toy consumer market U.S. is diverse and evolving. Women of different ages, backgrounds, and lifestyles are now using pleasure products. Each group has unique needs and preferences.

Younger consumers often seek exploration and sexual experiences tied to identity and empowerment. Older users may prioritize wellness, relaxation, or post-partum recovery. These motivations shape product choice and usage habits.

Trends in women’s sex toys show rising use in solo and couple-focused experiences. Many users now shop through online stores, drawn by privacy and variety. Digital platforms also offer reviews and guides, which help buyers make informed choices.

Based on distribution channel data, e-commerce dominates. However, physical retailers are gaining traction with curated displays and wellness-focused branding. These options make toys more approachable for first-time users.

Segmentation by age, intention, and relationship status helps brands design more personalized experiences. The modern market values emotional insight as much as physical pleasure.

5. Online Platforms and Distribution Channels

Digital retail plays a central role in the U.S. sex toys market. Over the past five years, online platforms have become the top choice for consumers seeking privacy, variety, and convenience.

E-commerce now accounts for over half of all purchases in the sex toy consumer market U.S.. Leading online stores offer product comparisons, customer reviews, and educational content. These features help new users feel confident and informed.

This shift gained speed during the COVID-19 pandemic. With physical shops closed, digital platforms became essential. Even now, buyers prefer discreet delivery and easy browsing. For brands, e-commerce also enables better data tracking and targeted marketing.

Based on distribution channel trends, major platforms such as Amazon and Lovehoney are expanding their adult categories. Boutique brands use Shopify and WooCommerce to create niche experiences. Some mainstream retailers, like Sephora, have even added wellness-oriented toys to their inventories.

While physical stores are growing, especially in urban centers, online platforms continue to dominate the market. They offer unmatched reach, personal service, and private shopping.

6. Regional Trends in the U.S. Sex Toys Market

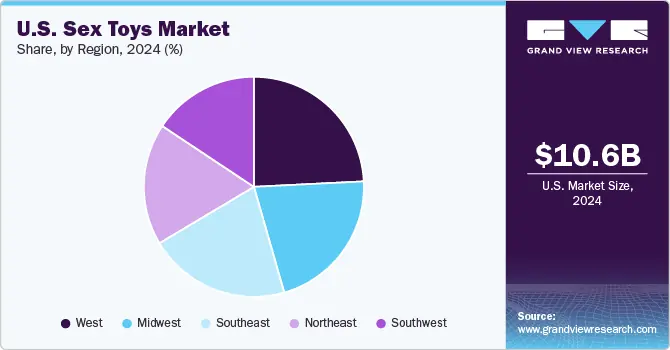

Regional dynamics shape the U.S. sex toys market in distinct ways. While demand is strong nationwide, a few key regions stand out.

The Western U.S.—especially California, Washington, and Oregon—dominates the market. These states show high product awareness and openness toward sexual wellness. Urban centers such as L.A. and San Francisco provide retail access and fast delivery.

In the Northeast, demand is growing fast. Cities like New York and Boston lead in luxury purchases and innovation. Consumers in this region often prefer high-quality, app-controlled products and support female-led brands.

The Midwest shows slower adoption but steady growth. Here, discreet packaging and educational marketing are critical. Southern states vary widely, with metro areas such as Atlanta and Austin performing well.

The market includes diverse consumer types across all regions. However, sex toys market size tends to correlate with urban density, digital access, and cultural openness.

As a result, regional marketing strategies must align with local needs, language, and social values. The Asia Pacific region also shows strong growth, especially in Japan, South Korea, and Southeast Asia.

7. Key Players in the U.S. Sex Toy Industry

The U.S. sex toys market is home to several key players known for innovation, quality, and inclusive branding. These companies set the tone for consumer expectations and industry standards.

LELO (Sweden-based, U.S. market leader) combines luxury design with quiet motors and innovative products. Its sculptural shapes and strong brand recognition make it a favorite in the premium segment.

Dame Products, founded in the U.S., focuses on ease of use and sexual wellness. The brand offers wearable vibrators and advocates for open conversations around pleasure and mental health.

We-Vibe leads in Bluetooth-enabled, app-controlled intimacy products and couples toys. Their tech-forward approach appeals to long-distance partners and younger buyers.

Satisfyer has grown rapidly through affordable pricing and strong e-commerce presence. It introduced pressure-wave technology and emphasizes sexual wellness through functional, body-safe designs.

Gaia in Love is a fast-growing Chinese sex toy brands adapting to international market challenges. Our smart features and body-safe materials have drawn U.S. interest. Products like the endoscopic vibrator and kegel trainer reflect a blend of sensual tech and women-centered design.

These brands cover all segments—from luxury designs to entry-level options, from pleasure to wellness. Together, they shape the future of intimacy in a fast-changing landscape.

8. Future Outlook: Growth Forecast and Innovation

The U.S. sex toys market is expected to maintain strong momentum during the upcoming forecast period. Analysts predict the market will continue growing at a CAGR of 8.38% through 2030. Behind this trend is a powerful mix of consumer demand, cultural change, and continuous technological advancements.

Future development will focus on smarter, safer, and more inclusive products. New devices may feature AI-driven feedback, biometric sensors, and personalized vibration modes. These innovative products will offer more than stimulation—they will deliver connection, confidence, and emotional support.

Reducing environmental impact is a growing priority for brands. Brands are exploring eco-friendly materials, reduced packaging waste, and ethical sourcing. These shifts reflect rising expectations from socially conscious buyers.

Despite global growth, the U.S. continues to lead in innovation and investment. E-commerce infrastructure, consumer openness, and wellness trends all contribute to long-term growth. The global sex toy market continues to expand, but the U.S. remains one of its most dynamic segments.

Beyond sales, brands now have a role in shaping sexual wellness through innovation and cultural leadership. South and Central America are emerging markets showing steady growth. Improved access and shifting values drive market expansion in these regions.

The 2025 tariff hikes have raised costs for many exporters, forcing brands to adjust pricing, logistics, and partnerships.

Sexuality is such a big part of who I am as a woman, and it’s a big part of my artistry. It’s about self-confidence, empowerment, and owning who you are.

Christina Aguilera

9. FAQs: Insights into the U.S. Adult Product Market

Q1: 2024 Market Size of the U.S. Sex Toys Industry

The market reached a value of approximately USD 10.6 billion in 2024. Among global categories, the U.S. sex toy market ranks among the highest in value and growth potential.

Q2: CAGR Forecast for the U.S. Sex Toys Market (2025–2030)

The market is growing at a CAGR of 8.38% from 2025 to 2030, driven by rising demand and technological advancements.

Q3: Key Consumer Trends in the U.S. Sex Toy Market

Today’s buyers value privacy, personalization, and emotional connection. Women’s sex toy trends reflect increased comfort with self-care, body awareness, and remote intimacy.

Q4: Top Product Features Driving Demand

App-controlled toys, including bullet and wand vibrators, are highly popular. Consumers also seek innovative products that align with their wellness goals.

Q5: Leading Sales Channels in the U.S. Sex Toys Market

Online stores remain the leading distribution channel in the U.S. sex toy market. Consumers choose online stores for privacy and education, fueling continued growth.

Q6: Major Brands and Key Players Shaping the Market

Major brands include LELO, Dame Products, We-Vibe, Satisfyer, and Gaia in Love. These key players focus on quality, design, and user experience. To survive the 2025 tariff war, some Chinese manufacturers are relocating or forming co-branded partnerships in the U.S.